Prepared by: Shri Partha Chatterjee.

Sunday, August 31, 2014

How to find the best Mobile and DTH tariffs

There are many service providers offering competitive tariffs and he gullible public get hooked to them by their aggressive ads leaving the users perplexed. Besides Mobile operators roll out and withdraw schemes on a daily basis. Here are a couple of tools which can help you to choose the apt mobile plan without burning a hole in your pocket: -

1.WWW.ireff.in

Every service provider has their own web site which is usually cluttered. Looking for specific

details such as a list of full talk time offers is difficult. WWW.ireff.in is a clutter free website that displays a consolidated list of prepaid recharge offers. Users need to enter their mobile operator’s name, the State of their living and ireff segregates the available results based on top-up packs, SMS packs, rate cutters, and internet packs. This web site is frequently updated. Ireff also has mobile application for Android, Windows phone and Black berry.

2.WWW.komparify.com

This web site helps users find the optimal plans based on their usage. When users enter their monthly mobile usage estimate such as their voice call, SMS and the duration of their internet browsing komparify automatically compares plans offered by various operators and list out rate cutters and top-ups that would be best suited for their requirements. Users can recharge their mobiles from the komparify web site itself.

Komparify helps users choose the optimal post-paid plans and DTH TV packages too.User can browse through all the offerings by various providers at a single window and compare them using komparify. Komparify has an Android application called ‘Plan found’ which tracks mobile usage patterns and based on this automatically suggest the best plans to choose.

R.K. Viswanathan

1.WWW.ireff.in

Every service provider has their own web site which is usually cluttered. Looking for specific

details such as a list of full talk time offers is difficult. WWW.ireff.in is a clutter free website that displays a consolidated list of prepaid recharge offers. Users need to enter their mobile operator’s name, the State of their living and ireff segregates the available results based on top-up packs, SMS packs, rate cutters, and internet packs. This web site is frequently updated. Ireff also has mobile application for Android, Windows phone and Black berry.

2.WWW.komparify.com

This web site helps users find the optimal plans based on their usage. When users enter their monthly mobile usage estimate such as their voice call, SMS and the duration of their internet browsing komparify automatically compares plans offered by various operators and list out rate cutters and top-ups that would be best suited for their requirements. Users can recharge their mobiles from the komparify web site itself.

Komparify helps users choose the optimal post-paid plans and DTH TV packages too.User can browse through all the offerings by various providers at a single window and compare them using komparify. Komparify has an Android application called ‘Plan found’ which tracks mobile usage patterns and based on this automatically suggest the best plans to choose.

R.K. Viswanathan

Page views hit 1809 on 26 Aug 2014

Court hearing days used to register maximum page visits to Chronicle from 1200 to 1500 visits. But now, even on an

ordinary day 26 Aug 2014, portal statistics show there were

1809 visits, average 1700

ordinary day 26 Aug 2014, portal statistics show there were

1809 visits, average 1700

Jan Dhan Scheme will not burden Banks, says Govt.

New Delhi, August 30

The government today said the Pradhan Mantri Jan Dhan Yojana (PMJDY) would not burden the banks as the scheme made a reasonable business case for them and there were enough inbuilt safeguards in the scheme. Finance Minister Arun Jaitley said 2.14 crore accounts had been opened under the scheme in less than two days.

The government today said the Pradhan Mantri Jan Dhan Yojana (PMJDY) would not burden the banks as the scheme made a reasonable business case for them and there were enough inbuilt safeguards in the scheme. Finance Minister Arun Jaitley said 2.14 crore accounts had been opened under the scheme in less than two days.

The Finance Ministry in a statement said the experience of certain banks was observed and it was found that financial inclusion makes a reasonable business case for the banks due to current and savings account deposits from such accounts.

The PMJDY will develop infrastructure for direct benefit transfer (DBT) schemes to be rolled-out soon. This will improve governance and plug leakages. In principle approval of 2% commission to be paid for the DBT Scheme has already been granted.

At present, an accidental insurance scheme is part of the RuPay Debit Card. The National Payments Corporation of India pays the premium out of the revenue generated from card transactions. There is no burden on the banks, the statement said.

The guidelines for the life insurance cover announced by the PM will be issued shortly. There will be no burden on the banks on this account. The ministry said Rs 5,000 overdraft limit would be given after satisfactory operation of the account for six months."

(RK Sahni)

Saturday, August 30, 2014

LIC stoops too low to conquer

Dear Editor,

We discovered that in the deposit (proposed to be) made in the Chandigarh HC Registry, something unbelievable has happened if one goes by the total figures shown in the Statement filed along with the Affidavit (detailed calculations were not offered/provided).

In a few cases, the spouses of the expired Pensioners unfortunately predeceased them and so there is no question of paying any family pension in such cases. Still LIC showed FP as paid/payable up to July 2014, the revision/up-gradation resulted in a negative variation as pointed out by Shri Mahadevan and the so called excess payment deemed paid/payable to the Family Pensioner was 'recovered' from the 'arrears' paid/payable up to the date of death of the Pensioner concerned. Is it double jeopardy or triple jeopardy?

I am sure the absurdity and the un-tenability of the formula will be adequately exposed in the contempt proceedings in Chandigarh, for what it may be worth.

Yet another striking reason to prove that those in LIC today dealing with the pensioners' issues including the cases in courts, need some counselling and help. The minimum they should realize is that they are not fighting their worst enemies - Pensioners are part of LIC in the past and in the present. Notwithstanding the clear indication that in our esteemed Chairman's horizon, Pensioners do not even 'exist' in LIC.

Thanks and regards,

M. Sreenivasa Murty

Shri Narendra Modi,Honorable Prime Minister

Respected Pradhan Mantriji

RE: PRIME MINISTER JAN DHAN YOJANA

You have today launched massive and ambitious PRIME MINISTER JAN DHAN YOJANA programme under financial inclusion with an object to provide banking facility to those who do not have bank accounts at present. The target fixed under the programme is to open 7.5 crores bank accounts within period of one year starting from 15th August, 2014. I wish to congratulate and compliment you for taking such a bold initiative to connect 7.5 crores households with the economic activity and prosperity of the country and remove “Financial Untouchability” from the country. As per the announcement made by you while inaugurating the programme in Delhi, on first day itself 1.5 crores new accounts have been opened under the programme and you have set the target to open balance 6.5 crores accounts by 26th January,2015 itself instead of waiting for next independence day.

2. On the basis of communications issued by the government and RBI and news items appearing in the media on the subject, the main features of the scheme are as under

FEATURES

(a) Target group is those households who do not have bank accounts at present and belonging to poor section.

(b) Bank accounts will be opened without much hassle and formality. RBI has issued guidelines to banks that KYC norms may be exempted for first 6 months for opening such accounts with maximum turnover of Rs. One lakh and balance in the account should not be more than Rs. 50,000 at any time.

(c) The account holder will be entitled to receive “RuPay” DEBIT CARD issued by National Payment Corporation of India simultaneously with opening of the account from day one FREE OF COST.

(d) The account holders will be automatically covered for accident insurance up to Rs. One lakh under the policy issued by HDFC FREE OF COST EVERY YEAR.

(e) In addition of the above, those who open accounts under the scheme by 26.01.2015 will be entitled to receive automatic life cover of Rs. 30,000 under the policy issued by Life Insurance Corporation of India FREE OF COST.

(f) Account holder will be eligible to receive overdraft facility of Rs. 5000 after 6

months of opening the bank account ON AUTOMATIC BASIS.

These are highly attractive and beneficial features for the common man which not only get modern and high tech banking facility but also get life and accident insurance cover. It is big social net to the poor.

3. However I strongly feel that to make the scheme

successful and sustainable, the following issues need

to be addressed immediately.

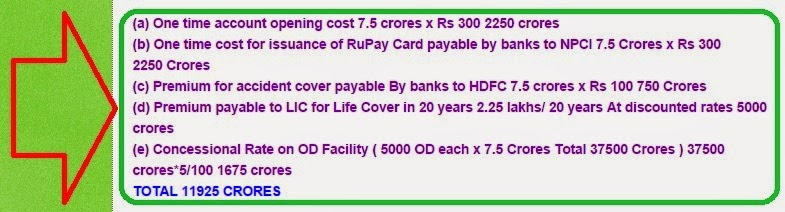

(a) COST FACTOR: Huge cost will be involved for implementation of this programme. New 7.5 crores to be opened will be more or less equivalent to 20 percent of existing deposit accounts being handled by the banking system of the country. I feel most of the accounts to be opened initially will be with ZERO balance.

The following 4 agencies in addition to government of India and RBI namely ( i ) Banks (ii) National Payment Corporation of India for issuing RuPay Debit Card (iii) HDFC Aro for issuing accident policy and settlement of claims (iv) LIC for issuing life cover and settlement of claims will be responsible for successful implementation.

Total insurance cover to be provided for 7.5 crores accounts under the scheme will be as under

(a) ACCIDENT INSURANCE COVER ONE LAKH x 7.5 CRORES 7.5 LAKH CRORES

(b) LIFE COVER 30,000 X 7.5 CRORES 2.25 LAKH CRORES

I presume the following cost for implementation of the scheme to achieve the target in the given time frame work

I understand that this cost incurred for implementation of the scheme will be borne by the government. But, initially payments will have to be made by banks and then reimbursements will be given to banks.

As you know public sector banks are already passing through severe profitability constraints. Such a huge expense burden will put further pressure on profitability front and will create further negative perception about PSU banks functioning among investors. I therefore suggest that claims for expenses incurred by different agencies in this regard may be directly settled by the government instead of bank settling first and then claiming reimbursement.

(2) COORDINATION AMONG DIFFERENT AGENCIES

5/6 different agencies will be responsible for implementation of the scheme while contact point for account holders and final delivery of the product will be at bank counters. Therefore it is very necessary that there should be perfect coordination among different agencies at all levels right from opening of accounts, delivery of debit card, mobile services , settlement of insurance cover etc to make it successful. In the absence of this, blame game can start among the implementing agencies derailing it earlier than expected.

(3) PROCEDURE HASSLES

(3) PROCEDURE HASSLESProcedure details need to be codified and documented immediately. Anxiety for speedy

implementation of the project can be well understood and appreciated but to open one and half crores accounts in single day and to further open 6.5 crores accounts in next 5/6 months without detailed procedure instructions to the operating staff can come as boomerang on the scheme in coming days and create serious question mark on its creditability as has happened on many schemes in the past. Some of the illustrations in this regard are given below

- (a) Presently, RBI has permitted opening of account only with production of photo and signature in the presence of bank officials without following normal KYC norms immediately and the same can be completed later on within maximum period of 6 months. Now, it should be clarified and instructions to be given as to what will happen after 6 months in case the account holder fail to comply KYC norms. Such cases are going to be large as the targeted group is less educated and migrating folk. Whether such accounts will receive fate of closer. You have shared your experience that Dena Bank officials chased you for 20 years for closer of your deposit account. You want that this programme should be for opening more and more bank accounts rather than closing of accounts after some time.

- (b) It is proposed that OD facility will be granted after 6 months of opening of the account subject to its satisfactory conduct. Most of these accounts will be opened with zero balance and either with no operation or with very limited operations in first 6 months in the absence of any credit facility. It should be immediately clarified that what will be norms for treating the account satisfactorily conducted. It should not be entirely left to the discretion of the operating staff. What will be procedure for grant of OD - whether on automatic basis or whether it will call for completion of paper work and documentation. Now all account holders have carried the impression that OD facility will be available to them from banks. In case the ratio of refusal goes high because of norms fixed or due to perception of bank officials, it will create huge dissatisfaction to the account holders.

- (c) Claim settlement procedure at LIC and HDFC need to be immediately codified and documented to avoid future dissatisfaction among the account holders. The procedure need to be advertised. In case of LIC what will be the cooling for lodgment of claim after opening of the account. Proper authorities should be created for settlement of such claims.

- (d) Banks have been given task of opening 7.5 crores new accounts in next 6 months. It is huge huge workload on the staff which are already overburdened due to staff shortage and increasing business and ever-increasing variety of products. Further the bank staff is at present highly de-motivated due to very poor payments compared to the much better service conditions prevailing in private banks and in the government sector. I have to draw your attention that wage negotiation for bank employees is pending for last 2 years without any finality. Govt./ IBA are sitting tight on it without any development. Such scenario is becoming frustrating for bank employees and fails to attract talent in the industry. How do you expect that under such conditions the programme will become successful at the bank level which is the most critical point for it. I therefore urge you immediately intervene in the matter and sanction attractive package to them.

- (e) The private sector banks should also be called upon to participate in this national programme of removal of financial untouchability. Today private sector banks control about 25 percent of total bank business. They should be asked to share at least proportionate responsibility and implementation of social programme should not be responsibility of PSU banks alone.

I hope my above suggestions will receive your attention and appropriate action will be taken wherever felt necessary. I wish all success in your endeavor.

With Respectful Regards

Yours Sincerely

SHARBAT CHAND JAIN, FORMER GENERAL MANAGER, BANK OF INDIA

D/1/1 SECTOR C SCHEME NO 71, INDORE 71 ( M.P. ) 452009 Mobil No 08966019488 Email sharbat_123@rediffmail.com

Date 28.08.2014

Family pension gets reduced on upgradation ?

DO YOU KNOW?

If LIC revises the pension on 1/8/1997 for pre-August 1997

pensioners as they have done while depositing the amounts in Jaipur

High Court Registry and Punjab & Haryana HC Registry for the

respective petitioners, and even if they follow the same pattern for

post -July, 1997 retirees, the Family Pension payable on such

revision will get reduced and not increased as per the present Family

Pension formula!

This,in my opinion, is due to the twin anomaly arising out of the LIC

having distorted the interpretation of the LIC Board Resolution dt

24/11/2001 and also the dismally anomalous formula for family

pension.

Unfortunately there is no one to fight for the helpless LIC family

pensioners numbering more than 12000 as on 3 1/3/2013 barring by the

pensioners' representative bodies through an incidental demand while

forcefully demanding upgradation of pension.

With greetings,

C H Mahadevan

If LIC revises the pension on 1/8/1997 for pre-August 1997

pensioners as they have done while depositing the amounts in Jaipur

High Court Registry and Punjab & Haryana HC Registry for the

respective petitioners, and even if they follow the same pattern for

post -July, 1997 retirees, the Family Pension payable on such

revision will get reduced and not increased as per the present Family

Pension formula!

This,in my opinion, is due to the twin anomaly arising out of the LIC

having distorted the interpretation of the LIC Board Resolution dt

24/11/2001 and also the dismally anomalous formula for family

pension.

Unfortunately there is no one to fight for the helpless LIC family

pensioners numbering more than 12000 as on 3 1/3/2013 barring by the

pensioners' representative bodies through an incidental demand while

forcefully demanding upgradation of pension.

With greetings,

C H Mahadevan

PRIME MINISTER JAN DHAN YOJANAPeople already having bank accounts also eligible Banks to hold camps every Saturday; to open 7.5 cr accounts by Jan 26

Sanjeev Sharma

Tribune News Service

Sanjeev Sharma

Tribune News Service

New Delhi, August 29

Consumers already having bank accounts can also participate in the government’s massive financial inclusion scheme, Pradhan Mantri Jan Dhan Yojana. The Finance Ministry said today that beneficiaries, who already have a bank account, are also eligible to take benefits of accident insurance of Rs 1 lakh and life insurance of Rs 30,000 under this scheme by getting a RuPay card issued from their bank branch before January 26 next year.

Consumers already having bank accounts can also participate in the government’s massive financial inclusion scheme, Pradhan Mantri Jan Dhan Yojana. The Finance Ministry said today that beneficiaries, who already have a bank account, are also eligible to take benefits of accident insurance of Rs 1 lakh and life insurance of Rs 30,000 under this scheme by getting a RuPay card issued from their bank branch before January 26 next year.

(rk sahni)

Pension updation

It is good gesture of the Finance Secretary, Shri Sandhu (He is reportedly liberal, pro employees, pro pensioners - unlike predecessor/s) to give patient hearing to our leaders on a mission.

The Director( Finance ) had a brief (heart to heart) talk with the Chairman, LIC to know some details / position of pending cases in Courts regarding updation of pension and removal of DA/DR anomaly to pre August, 1997 Pensioners. The Chairman might have confided GOI and LIC stand with the Director to convey to the Finance Secretary. What exactly transpired then and happened thereafter is everybody's guess. No wrong if everyone is hopeful of hearing something good. But, how long live on hopes.... till bid good bye to family and friends / till a day after which there is no need to be reminded to furnish *existence certificate to office.

The Director( Finance ) had a brief (heart to heart) talk with the Chairman, LIC to know some details / position of pending cases in Courts regarding updation of pension and removal of DA/DR anomaly to pre August, 1997 Pensioners. The Chairman might have confided GOI and LIC stand with the Director to convey to the Finance Secretary. What exactly transpired then and happened thereafter is everybody's guess. No wrong if everyone is hopeful of hearing something good. But, how long live on hopes.... till bid good bye to family and friends / till a day after which there is no need to be reminded to furnish *existence certificate to office.

Another disappointing omission (not a right word (?) as his address was to the Unions) is that there was not a word about pensioners. Better he had touched on the issues that he had interacted with MOF a week back regarding updation of pension, 100% DR to pre 1997 pensioners. A passing remark in his speech on these issues and uniform family pension on the lines of family pensioners of GOI and increase in amount of ex gratia, all the burning issues of the old and very old pensioners/retirees would have made a big difference, a feeling that the Chairman too cares.

SN ( a 1992 pensioner)

*Existence certificate. [ It is life certificate in GOI, RBI etc. It is existence certificate in LIC. Rightly defined to connote that Pensioners - LIC Pensioners (some and not all because of the Indian Family Culture) EXISTING ( hand to mouth- I admit some hyperbole in the statement ) and NOT LIVING until the final exit. ]

The Director( Finance ) had a brief (heart to heart) talk with the Chairman, LIC to know some details / position of pending cases in Courts regarding updation of pension and removal of DA/DR anomaly to pre August, 1997 Pensioners. The Chairman might have confided GOI and LIC stand with the Director to convey to the Finance Secretary. What exactly transpired then and happened thereafter is everybody's guess. No wrong if everyone is hopeful of hearing something good. But, how long live on hopes.... till bid good bye to family and friends / till a day after which there is no need to be reminded to furnish *existence certificate to office.

The Director( Finance ) had a brief (heart to heart) talk with the Chairman, LIC to know some details / position of pending cases in Courts regarding updation of pension and removal of DA/DR anomaly to pre August, 1997 Pensioners. The Chairman might have confided GOI and LIC stand with the Director to convey to the Finance Secretary. What exactly transpired then and happened thereafter is everybody's guess. No wrong if everyone is hopeful of hearing something good. But, how long live on hopes.... till bid good bye to family and friends / till a day after which there is no need to be reminded to furnish *existence certificate to office.

Our Chairman, as stated above, had a talk with a very senior officer of Ministry of Finance few days back. (Third week of August ). The Editor has posted the Chairman's Speech for Information Sharing Session with Unions. It is heartening to know a good deal about LIC, our new generations impressive achievements in the competitive market, awards galore, challenges awaiting etc.etc. But, it is not heartening to know that he has offered to staff a mere 10.50% hike ? IBA has offered 11.00%. (Banks Unions may agree anything between 15% and 20%). Why the insurance industry (LIC) need (always) be subservient to banking industry (Banks)? The latter have made inroads into insurance sector ... Our Chairman can rise to the occasion and offer more hike.

Another disappointing omission (not a right word (?) as his address was to the Unions) is that there was not a word about pensioners. Better he had touched on the issues that he had interacted with MOF a week back regarding updation of pension, 100% DR to pre 1997 pensioners. A passing remark in his speech on these issues and uniform family pension on the lines of family pensioners of GOI and increase in amount of ex gratia, all the burning issues of the old and very old pensioners/retirees would have made a big difference, a feeling that the Chairman too cares.

SN ( a 1992 pensioner)

*Existence certificate. [ It is life certificate in GOI, RBI etc. It is existence certificate in LIC. Rightly defined to connote that Pensioners - LIC Pensioners (some and not all because of the Indian Family Culture) EXISTING ( hand to mouth- I admit some hyperbole in the statement ) and NOT LIVING until the final exit. ]

Friday, August 29, 2014

LIC Chairman on wage talks

Is the 10.5% wage rise proposed by Chairman includes

corresponding revision of pension(after upgradation) or

excludes it?

A clarification needs to be sought from LIC Chairman by

all retired employees' Associations/Federations in the

context that three High Court judgments are binding on

LIC to provide for upgradation of pension for pre-Aug 2007

pensioners pensioners.

It is high time that LIC Management invited Pensioner Bodies'

representatives for talks before arriving at any wage revision

decision in the present context.

Kind regards.

C H Mahadevan

corresponding revision of pension(after upgradation) or

excludes it?

A clarification needs to be sought from LIC Chairman by

all retired employees' Associations/Federations in the

context that three High Court judgments are binding on

LIC to provide for upgradation of pension for pre-Aug 2007

pensioners pensioners.

It is high time that LIC Management invited Pensioner Bodies'

representatives for talks before arriving at any wage revision

decision in the present context.

Kind regards.

C H Mahadevan

Meeting with Shri Sandhu,Secretary (Finance)

DEAR EDITOR,

|

| PP Dhamija |

RECENTLY SOME REPRESENTATIVES OF THE PENSIONERS ASSOCIATION MET SHRI SANDHU, SECRETARY FINANCE GOVT. OF INDIA, SHRI SRIVASTAVA, DIRECTOR INSURANCE AND SECRETARY PENSIONS (GOI) AND DISCUSSED THE CASES OF PENSIONERS. IT IS SURPRISING THAT THE GOVT. OFFICIALS WERE NOT KNOWING THE CASE OF LIC PENSIONERS AND THEY HAD TO TALK TO THE LIC CHAIRMAN ABOUT THIS. THAT THE GOVT. OFFICIALS GAVE A POSITIVE HEARING IS HIGHLY APPRECIATED. THE EFFORTS OF THE TEAM REQUIRE THREE CHEERS.

WE ALL KNOW THAT OUR LEGAL CASES ARE IN THE FINAL STAGES AND THE SUPREME COURT MAY TAKE UP THE APPEAL OF LIC AGAINST THE JUDGMENTS OF JAIPUR, CHANDIGARH AND DELHI HIGH COURTS AND TAKE A FINAL DECISION. AT THIS STAGE, MEETING WITH THE GOVT. OFFICIALS WAS A RIGHT STEP OR NOT IS TO BE SEEN.

WHEN LAST TIME MR. G.N. SRIDHARAN MET THE SECRETARY, FINANCIAL SERVICES, THERE WAS LOT OF HUE AND CRY. WHY MR. GNS IS MEETING THE GOVT. OFFICIALS AND THE CHAIRMAN WHEN OUR CASE IS IN THE FINAL STAGE. LET THE PENSIONERS PONDER OVER THIS.

WHEN LAST TIME MR. G.N. SRIDHARAN MET THE SECRETARY, FINANCIAL SERVICES, THERE WAS LOT OF HUE AND CRY. WHY MR. GNS IS MEETING THE GOVT. OFFICIALS AND THE CHAIRMAN WHEN OUR CASE IS IN THE FINAL STAGE. LET THE PENSIONERS PONDER OVER THIS.WHEN WE READ THE REPORT IT STATES —“WE SAID FOR THE PRESENT THE DA/DR ISSUE HAS BECOME STALE SINCE IT CAME TO AN END ON 31.7.1997”.....

HOW THE CASE OF DA/DR ANOMALY CAN BECOME STALE WHEN THE INTEREST OF PENSIONERS WHO RETIRED PRIOR TO 1ST AUGUST’ 1997 IS INVOLVED. THERE ARE ABOUT 40% PENSIONERS WHO RETIRED PRIOR TO 1ST AUGUST, 1997 AND THEY ARE BEING PAID LESS DA/DR. THESE PENSIONERS ARE IN THE AGE GROUP OF 75 PLUS AND MANY OF THEM HAVE ALREADY LEFT THE WORLD WITHOUT GETTING THE BENEFIT. THOSE WHO RETIRED AFTER 31ST JULY, 1997 ARE GETTING FULLY NEUTRALISED DA/DR AT A HIGHER RATE. SO NO ONE CAN SAY THAT THE DA/DR ISSUE HAS BECOME STALE. THIS IS HIGHLY OBJECTIONABLE.

AGAIN THE REPORT READS—“ MR SANDHU ASKED MR. SRIVASTAVA TO LOOK INTO THE MATTER OF DA/DR ANOMALIES AND CLEAR THE SAME” THIS SHOWS THE MIND OF THE GOVT. OFFICIALS.

THE SECRETARY FINANCE TALKS TO THE LIC CHAIRMAN IN PRESENCE OF THE PENSIONERS’ REPRESENTATIVES AND ENQUIRES THE POSITION. THIS IS ALL A GIMMICK TO PLEASE THE PENSIONERS. WE ALL KNOW THAT NO ACTION WILL BE TAKEN TILL THE APPEAL OF LIC IS DECIDED BY THE SUPREME COURT.

THE NEXT COMMENT OF THE SECRETARY FINANCE “ BUT THE SAME WAS A WIDER ISSUE INVOLVING BANKS AND GIC PENSIONERS ALSO. LET US SEE AND WE WILL TRY TO FIND OUT A WAY” AGAIN SHOWS THE MIND OF THE GOVERNMENT. AFTER THE NEW GOVT. CAME INTO POWER, SO MANY ASSOCIATIONS HAVE GIVEN MEMORANDA TO THE MINISTERS. THOSE MEMORANDA MUST HAVE ALREADY BEEN IN THE HANDS OF GOVT. OFFICIALS. THE GOVT. MAY NOT TAKE ANY ACTION TILL THE SUPREME COURT DECIDES THE APPEAL OF LIC. WE CANNOT REJOICE ON WHAT THE GOVT. OFFICIALS SAY. WE HAVE TO WAIT AND WATCH.

THE CIVIL APPEAL OF LIC AGAINST THE JUDGMENTS OF JAIPUR, CHANDIGARH

AND DELHI HIGH COURTS IS LIKELY TO COME UP ANY TIME. THE DECISION OF THE SC MAY BE:

1. DISMISS THE APPEAL OF LIC AND ADVISE FOR IMPLEMENTATION OF THE BOARD DECISION.

IN SUCH A CASE WE KNOW THE MIND OF LIC AND THE GOI WHO WILL SIMPLY RELEASE THE DIFFERENCE OF DR AS HAS BEEN DONE IN JAIPUR AND CHANDIGARH.

2. DISMISS THE APPEAL OF LIC AND ADVISE:

(i) REMOVE DA/DR ANOMALY IN RESPECT OF PRE AUGUST 1997 RETIREES AS PER BOARD RESOLUTION.

(ii) REVISE PENSION OF ALL PENSIONERS FROM 1.8.1997, 1.8.2002 AND 1.8.2007 AND SO ON AS PER DECISION OF THE JAIPUR SINGLE JUDGE DECISION ON THE SECOND WP.

THIS WILL CERTAINLY BE A WELCOME DECISION BY ALL.

3. ALLOW THE APPEAL OF LIC IN RESPECT OF SECTION 48 OF LIC ACT AND ADVISE THE PENSIONERS THAT THIS IS A MATTER WITHIN THE POWERS OF THE CENTRAL GOVT.

LET US KEEP OUR FINGERS CROSSED AND WAIT FOR THE DECISION OF THE SUPREME COURT.

LET THE ASSOCIATIONS WHOSE CASES ARE TIED UP IN THE SC APPEAL MAKE SURE THAT THEIR ADVOCATES SPEAK THE SAME LANGUAGE WHILE CONTESTING THE APPEAL OF LIC.

THEY SHOULD TALK TWO POINTS ONLY:

(A) LET THE LIC IMPLEMENT ITS OWN DECISION TAKEN IN ITS BOARD MEETING ON 24.11.2001.

(B) IMPLEMENT THE ORDER OF THE SINGLE JUDGE JAIPUR HIGH COURT ALLOWING THE SECOND WP ABOUT RAISING THE PENSIONS OF RETIREES AS AND WHEN THE GRADES ARE REVISED FOR IN-SERVICE EMPLOYEES.

THANKS.

P.P. DHAMIJA

RETIRED SR. DIVISIONAL MANAGER

09810186067

May Lord Ganesha bless !

I am constrained to stroll into the happenings during the meeting of our representatives with Shri Sandhu, Finance Secretary, GOI. It was reported that Shri Sandhu called Shri Srivastava, Director, Insurance (LIC) and asked about our matter, the two issues and the ongoing litigation and he replied that he is ignorant of the matter ! Strange are the ways how some departments work and their lacuna in their inter-departmental communication.

There after Shri Sandhu asked the Director to collect all the details from LIC about the reasons for not implementing the judgments and unwanted litigations without the notice of the Director. You could very well imagine what could be the expected

answer: As the dispute is before the Apex court we are awaiting its final verdict and any action to be taken now outside the court will be subjudice.

On the auspicious VINAYAKA chathurthi I pray Lord Ganesha, the remover of obstacles to bless us to get our lawful rights, the twin benefits of removal of DR anomaly and pension upgradation without any more delay.

R.K.Viswanathan

answer: As the dispute is before the Apex court we are awaiting its final verdict and any action to be taken now outside the court will be subjudice.

On the auspicious VINAYAKA chathurthi I pray Lord Ganesha, the remover of obstacles to bless us to get our lawful rights, the twin benefits of removal of DR anomaly and pension upgradation without any more delay.

R.K.Viswanathan

RBI announces simplified KYC norms

MUMBAI: Reserve Bank of India announced simplified 'know your customer' (KYC) norms for low-risk customers ahead of the launch of the Prime Minister's Jan Dhan Yojana on Thursday. Under the new norms low-risk customers can provide KYC documents within six months of opening the account.

The Pradhan Mantri Jan Dhan Yojana will be launched by Prime Minister Narendra Modi on completion of 100 days of the new government. The scheme envisages financial inclusion by initially providing every household with a bank account. Subsequently through this account the underprivileged will get subsidies, insurance cover, and overdraft facilities.

Those persons who do not have any of the 'officially valid documents' can open 'small accounts'

with banks. A 'small account' can be opened on the basis of a self-attested photograph and either a signature or thumb print in the presence of an official of the bank. Such accounts have limitations regarding the aggregate credits (not more than Rupees one lakh in a year), aggregate withdrawals (not more than Rupees ten thousand in a month) and balance in the accounts (not more than Rupees fifty thousand at any point in time). "These small accounts would be valid normally for a period of twelve months. Thereafter, such accounts would be allowed to continue for a further period of twelve more months, if the account holder provides a document showing that she/he has applied for any of the officially valid document, within twelve months of opening the small account," RBI said.

Earlier RBI had clarified that there is no requirement of submitting two separate documents for proof of identity and proof of address. If the officially valid document submitted for opening a bank account has both, identity and address of the person, there is no need for submitting any other documentary proof. Officially valid documents (OVDs) for KYC purpose include: passport, driving licence, voters' ID card, PAN card, Aadhaar letter issued by UIDAI and Job Card issued by NREGA signed by a State Government official.

"Since migrant workers and transferred employees often face difficulties while submitting a proof of current address for opening a bank account, such customers can submit only one proof of address (either current or permanent) while opening a bank account or while undergoing periodic updation. If the current address is different from the address mentioned on the proof of address submitted by the customer, a simple declaration about current address would be sufficient," RBI said.

The Pradhan Mantri Jan Dhan Yojana will be launched by Prime Minister Narendra Modi on completion of 100 days of the new government. The scheme envisages financial inclusion by initially providing every household with a bank account. Subsequently through this account the underprivileged will get subsidies, insurance cover, and overdraft facilities.

Those persons who do not have any of the 'officially valid documents' can open 'small accounts'

with banks. A 'small account' can be opened on the basis of a self-attested photograph and either a signature or thumb print in the presence of an official of the bank. Such accounts have limitations regarding the aggregate credits (not more than Rupees one lakh in a year), aggregate withdrawals (not more than Rupees ten thousand in a month) and balance in the accounts (not more than Rupees fifty thousand at any point in time). "These small accounts would be valid normally for a period of twelve months. Thereafter, such accounts would be allowed to continue for a further period of twelve more months, if the account holder provides a document showing that she/he has applied for any of the officially valid document, within twelve months of opening the small account," RBI said.

Earlier RBI had clarified that there is no requirement of submitting two separate documents for proof of identity and proof of address. If the officially valid document submitted for opening a bank account has both, identity and address of the person, there is no need for submitting any other documentary proof. Officially valid documents (OVDs) for KYC purpose include: passport, driving licence, voters' ID card, PAN card, Aadhaar letter issued by UIDAI and Job Card issued by NREGA signed by a State Government official.

"Since migrant workers and transferred employees often face difficulties while submitting a proof of current address for opening a bank account, such customers can submit only one proof of address (either current or permanent) while opening a bank account or while undergoing periodic updation. If the current address is different from the address mentioned on the proof of address submitted by the customer, a simple declaration about current address would be sufficient," RBI said.

Courtesy: RK Sahni.

Dear Friends,

I wish a warm and hearty welcome to each one of you present here today for this Information Sharing Session. This is the second meeting for the wage revision and first in the current year. I extend my appreciation for your support during the previous Financial year. I also wish to share with you my views on the present status of our Organisation and expected developments during the forthcoming years.Financial Sector Scenario:

The economies and the financial policies of a country are intricately linked with what is going round at the global level. In the Budget for 2014-15, the Hon’ble Finance Minister has made the following announcements which impact us:-

a) Limit u/s 80C has been increased from 1 lac to 1.5 lac

b) Housing loan interest rebate increased from 1.5 lac to 2 lac- More money in the hands of people

c) PPF limit increased to 1.5 lac- may neutralize the +ve impact of enhanced 80C limit

d) Proposal to hike FDI limit in Insurance to 49%

e) Aim to provide all household with banking facility- this will boost financial inclusion.

After getting access to the banking, insurance will be the next financial product required by the

You are aware that the Union cabinet has approved a proposal to ease foreign direct investment (FDI) limit in the domestic insurance sector to 49% from 26%. This signals

Government’s intent to draw capital and investment into an economy that is struggling to

claw out of a crippling slowdown. As of now the Bill has been referred to Select Committee. However, whatever the outcome, Corporation has to be prepared for all eventualities. Historically, we have performed exceedingly well inspite of competition. But this time the competition is going to be more intense as our competitors are equipped with almost 14 years of experience of the Indian insurance market.

Friends, we are sailing through the era where change is so fast that sometimes it even outpaces the minds and anticipations of celebrated economists. The overall economic situation of the country has been the matter of concern for all. Government and all the stakeholders are trying to rein the situation and boost the growth which had gone down to below 5%. Green shoots of revival are visible and we are of the belief that the India growth story has just started and has enough domestic drivers to grow exceptionally for several decades. We need to leverage this growth potential for the benefit of our Organization and policy holders. We need to be ready with all our resources and commitment to be not only the part of this growth but also to act as Growth driver.

Insurance Sector and LIC –

As I mentioned earlier, Indian insurance market is presently not what it was a decade back. Companies have established their foothold in the market and many of them have started showing profits as well. With the experience of almost one and half decade, now they have better understanding of “how to do business in India”.

Many regulatory developments during last 4-5 years have brought a sea-change in insurance market in India. New product guidelines are in place. Many other initiatives regarding the protection of interests of policy holders and bringing greater transparency in the market have been introduced. These developments are good for the industry but require swiftness in action and change in strategies to cope with it. We being a mammoth organization, communicating changes down the line to each employee and agent and then making them ready for the changed scenario, takes time.

In my view, differentiation in terms of product may not be the key to maintain the leadership position in future. Products are being replicated and will be replicated in future.

The next war in Indian insurance market may be fought on ‘Service differentiation’. This is

going to be the crucial factor for maintaining our position of ‘Preferred insurer’. In such war, skilled and committed sales and administrative manpower which should be having the attitude and aptitude to understand the expectations of customers well in advance and respond to them in a manner unprecedented for him, is an essential element.

Agency recruitment and retention had been the issue of concern for us during last few years. As on 31st July, 2014 we are still showing de-growth in Net agency strength. Apart from expanding the size of agency force, transforming them into a skilled and professional force for the next level of competition will acquire greater importance in coming years.

Our knowledgeable staff and field force are a great strength. This strength has to be strengthen further constantly in terms of upgrading their skills and their availability to the customers. We need to constantly upgrade our technology and the people using that technology to provide an unparalleled experience to the customers. We, as a leader of the market have to start this change as we do not have the option to remain complacent. We have to redefine our manpower distribution practices and work distribution practices. Each and every employee should be equipped with the knowledge and technology to render all the standard services customer may expect from the organization. It is not a matter of our convenience but the preference would be to the convenience of the customers. Our survival and pole position will fully depend on the opinion of customers about our servicing standards and his perception towards our sensitivity for their issues.

The time has come for us to start taking steps to synergize our activities with the changing

environment. Apart from the redistribution of work force, we need to work on improving the

overall experience of the customer whenever he chooses to visit the branch. A clean, modern and tidy look in our branches has to be created and maintained. Such a modern

look coupled with the impeccable services rendered by an employee in an empathetic way, can provide an experience to the customer which will go a long way for maintaining his loyalty. Any organization is strong only till the time it remains relevant in the eyes of its customers. Changing loyalty may prove catastrophic for any service organization and in service organization loyalty of customers changes very fast.

On the technology upgradation front, I proposed during our last session about the introduction of the Biometric system for Password. This will not only address the issue of many password frauds that happened in the Corporation but also smoothen and expedite the process of servicing. Moreover, this is the upcoming technology and we cannot shy away from it.

Our performance:

For the year 2014-15, we have taken the budget of 3.68 crore individual policies and Rs.35,000 crore FPI. The first quarter of the current fiscal has been good for us. As on 31st July 2014, Corporation has procured 6580.56 crore FPI under 41.36 lakh policies thereby registering a growth of 5.63 % in FPI. However, there is de-growth of 46.73% in NOP. The A2B in NOP & FPI is 11.24 % & 18.80 % respectively.

As of now we have 12 products in the individual category and have done better than quarter one last year, when we had 48 products. Recently ‘Varistha Pension Bima Yojna’ has again been introduced by Govt. to be administered by LIC. This shows the faith of the Government in us. We have also introduced another new plan “Jeevan Rakshak” and expect the market will receive it well.

The excellent performance in P&GS deserves a mention here. For the last couple of years, our Pension & Group Schemes Department has been a major contributor for the Corporation. We are very proud of the fact that all the large corporates in the country repose their trust in us to manage their liabilities or their funds.

Claim Settlement:

Claims performance was extra-ordinary with 99.68% Maturity/SB and 99.30% Death Claims having been settled. One of the major elements for retaining the market share as well as customer’s trust is our outstanding claims performance. However, speed ratio is an area of concern as the entire claim performance will depend on timely dispatch of intimations. Claim settlement offers immense marketing opportunities as well as opportunities to generate goodwill and strengthen Brand LIC. This being so, we should observe very high standards of professionalism and ethical processes while settling claims.

Recruitment:

You are aware that we have regularised all regular part-time sweepers as Sweeper cum attendants. Our future recruitments will be need based and in the areas of our core activities.

Sports Activity:

As far as sports activity is concerned, six Sports Disciplines are covered in All India LIC

Sports. The last round of recruitment under Sports quota was completed in March 2012

with a view to retain competitive excellence in the field of sports and to compete on equal

footing with other organizations. The sports Policy of LIC is under review.

Awards Won & Brand Survey:

During the Financial Year 2013-14 we have won as many as 31 awards. Some of the notable awards being Readers Digest Trusted Brand, Skoch Renaissance Award, Outlook Money Award, Annual Greentech CSR Awards and Asian Sustainability Leadership Award. We were also ranked among “Top-10 Most Trusted Brands in India” and were voted as No. 1 “Most Trusted Insurance Brand” in the ET Brand Equity-Nielsen Survey-2013. It has been a great achievement year for LIC.

New initiatives:

It is proposed to take new initiatives in Direct Marketing like On-line marketing to start in a

significant manner. We have launched ‘e-Term’ product recently and plan to have at least

one product in each category (Annuity/ Endowment/ Children/ Health/ Investment/ ULIP).

We are also planning for Corporate Business Vertical to approach Corporates across India for direct business.

Issues for discussion:

We have to address the following issues to ensure the sustainable growth of our Organization:-

(1) Code of conduct: It is expected that:

(a) Union work shall be done only after office hours.

(b) Holding any kind of meeting, demonstration, slogan shouting, announcement during office hours and/or inside the office premises shall not be resorted to by the Unions and employees.

(2) Improvement in Productivity, Redeployment and Mobility of Workforce: Taking into account the exigencies of the office and the directions from CVC, the employees shall be liable to transfer and/or inter-change of duties, either within the station or outside. Unions may give their suggestions about such redeployment in line with the requirement of the Corporation and practices followed by other

financial institutions.

(3) Adaptation and Upgradation of technology: EDMS project has brought in a new era of servicing. This is going to provide us the convenience for all standard customer services to the customers at one single point. With the use of technology, cases of impersonation and password frauds are on the rise. To address the issue and make the process more secure for employees, we will bring Biometric authorization in place of password. I have already mentioned during my address at the 54th All India Senior Divisional Manager’s Conference that we are working on a system whereby individual employee productivity will be assessed through the Back end.

(4) Customer Orientation: In order to ensure greater customer care, the Corporation will introduce customer friendly measures and implement the same with the co-operation of the Unions. In the light of customer oriented market conditions, initially we propose to introduce

the following customer friendly measures:

• Extension of cash hours by one hour

• Single window servicing concept

• Developing Mini-Offices as ‘Growth Centres’.

• Modern and tidy atmosphere in branches

As in previous year, we will be rolling out HRD/OD program, titled ‘We Can’, this year,

starting 01st September, covering employees and officers from RC to AO.

Offer on wage revision :

Taking a holistic approach of the aspirations and also the presently prevailing conditions, I wish to offer 10.50% as wage rise. I request you to discuss further modalities with Personnel Department. I once again sincerely thank you for the co-operation and contribution you have extended during all these years. I am sure that it will be continued. Thank you.

Thursday, August 28, 2014

Matter of pride

Go through the blog for last few months and archives.

Go through the blog for last few months and archives. The Editor has chronicled mainly the pension related issues and other aspirations of LIC Pensioners in particular.

He has very systematically shared the court proceedings/ developments.

He has given wide spectrum/ more than enough space in the blog to all (including commoners) to scribble / to express fair and free thoughts without fear or favour - all for the ultimate good of pensioners.

He has highlighted faithful reactions, views and counter views.

He has also carried few details of pension matters in GOI, RBI and banks for appreciating grievances of pensioners other than that of LIC Pensioners.

He also publishes articles of interest for day today use/benefit of pensioners. Also, poems, titbits, cartoons etc., a diversion of sort for readers.

He without giving an inkling to the writers makes suggestions / edits to ensure the write ups are not banal or unworthy of posting.

It is, I say, a statement of fact in my case. The blend of colour and representative pictures accompanying the articles are characteristically charming and unique to Shri P.G. Gangadharanji.

The blog has never been or is the exclusive domain of Shri P.G.

It is not brought out for airing the Editor's personal views/ideas/opinions.

- The LIC PC is reportedly read by some three to four times daily.

- The pensioners are keen awaiting new postings, breaking news by the Editor.

- They must be feeling better to know some thing good in the offing, may be they get positive energy by glancing through / reading the pages of the PC .

- Its popularity is therefore increasing every month as could be observed by the growing number of viewers which has crossed five lakhs (now at present rate read by nearly 6 lac pensioners an year. -Ed.)

- The Editor has directly or indirectly, knowingly or unknowingly enlivened the lives of pensioners keeping them abreast of the latest.

- They are happy with the overall contents of LIC Pensioners Chronicle.

- The title of the blog ,'LIC Pensioners Chronicle' is apt and absolute: over a period of time, it has become the heart throb of Pensioners of Life Insurance Corporation of India.

- LIC Pensioners Chronicle is remarkably edited by Shri P.G.Gangadharan in the interest and for well being of the pensioners .

Wednesday, August 27, 2014

Some more light on pre-1986 retirees

The following is from CHARTER OF DEMANDS Booklet of AIRIEF presented & also discussed with top LIC management, COD: Our expectations:Health,Happiness & Harmony

1) i) Regarding Pre -1986 Exgratia Retirees, AIRIEF demands Liberal Medical Assistance (MA) per month on the pattern allowed by RBI, which has been constantly increasing this benefit knowing full well that they are the oldest & much above 82 yrs old.

LIC must understand that they have saved a lot by denying to legitimate demands all these years & years & so now must be unhesitatingly magnanimous.

Exgratia retirees is a closed cadre, many deaths have taken place, mortality will snatch away many. LIC should not be miserly. The number has dwindled considerably from 5500-----850

In fact, this small relief to exgratia retirees can be done by LIC top management itself. With such a calamitous decline because of so many deaths & such a small number alive & on records, wisdom should dawn & solution found. Spouses numbers stand at 2650app All India.

ii) Medical Assistance (MA) per month (MMA), ranging from Rs3000--5000pm, slightly less than RBI. It can be

Upto Assts :Rs3000pm

HGA/DOs :Rs3500pm

AAO/AO :Rs.4000pm

ADM/DM/SDM :Rs.4500pm

ZM & Above:Rs.5000pm

Already, these Elders, whom we must respect to the core, have already lost the battle. It was a pittance of Rs 300+DR they are getting, society looks to them with scorn, when nowadays Substaff gets such substantial pension. A Substaff now gets Basic pension at maximum grade Rs.7207, Commutation Rs.2402, so Existing BP Rs4805, DR Rs 6119, in all Rs10,924.

How much all pensioners spend on Health matters for consultation, medicines, special reports,dental treatment throughout the year, everyone knows.

Pre-1986 retirees, so old, will have plenty of ailments& even immobile.Year after year, there will be exits. The approximate outlay for exgratia retirees will be less than Rs 4 cr per annum, peanuts to LIC & LIC Outlay will, therefore, come down. We shall pursue the matter with the authorities.

iii)CG/State Govt retirees always got with successive Pay Commissions automatically.

Minimum Pension for CG has shot up to Rs3500 +DR

1) i) Regarding Pre -1986 Exgratia Retirees, AIRIEF demands Liberal Medical Assistance (MA) per month on the pattern allowed by RBI, which has been constantly increasing this benefit knowing full well that they are the oldest & much above 82 yrs old.

RBI protected them from 1/6/2001 with small Rs.300pm, Rs.800 wef 1/7/2002,Rs1000/1200 from 1/2/2005 for Class III, Rs1200/1500/1800 for Class I Wef 1/4/08,MA pm Rs3400-5600 for Class IV -- Grade F/ED

How frequently RBI has done the revision speaks high of RBIs concern for all types of pensioners & exgratia retirees.

How frequently RBI has done the revision speaks high of RBIs concern for all types of pensioners & exgratia retirees.

UCOBank has allowed Rs.5000pm for exgratia retirees as also widows same amount.

LIC must understand that they have saved a lot by denying to legitimate demands all these years & years & so now must be unhesitatingly magnanimous.

Exgratia retirees is a closed cadre, many deaths have taken place, mortality will snatch away many. LIC should not be miserly. The number has dwindled considerably from 5500-----850

In fact, this small relief to exgratia retirees can be done by LIC top management itself. With such a calamitous decline because of so many deaths & such a small number alive & on records, wisdom should dawn & solution found. Spouses numbers stand at 2650app All India.

ii) Medical Assistance (MA) per month (MMA), ranging from Rs3000--5000pm, slightly less than RBI. It can be

Upto Assts :Rs3000pm

HGA/DOs :Rs3500pm

AAO/AO :Rs.4000pm

ADM/DM/SDM :Rs.4500pm

ZM & Above:Rs.5000pm

Already, these Elders, whom we must respect to the core, have already lost the battle. It was a pittance of Rs 300+DR they are getting, society looks to them with scorn, when nowadays Substaff gets such substantial pension. A Substaff now gets Basic pension at maximum grade Rs.7207, Commutation Rs.2402, so Existing BP Rs4805, DR Rs 6119, in all Rs10,924.

How much all pensioners spend on Health matters for consultation, medicines, special reports,dental treatment throughout the year, everyone knows.

Pre-1986 retirees, so old, will have plenty of ailments& even immobile.Year after year, there will be exits. The approximate outlay for exgratia retirees will be less than Rs 4 cr per annum, peanuts to LIC & LIC Outlay will, therefore, come down. We shall pursue the matter with the authorities.

iii)CG/State Govt retirees always got with successive Pay Commissions automatically.

Minimum Pension for CG has shot up to Rs3500 +DR

2) Exgratia retirees get Rs300 +DR2779+Rs1000 Cash Medical Benefit ie Rs4079pm

Spouses get BP Rs175 +DR1456 +CMB Rs500 ie Rs2131. Latest revision has brought impact of DR extra for Spouse, some relief.

NOW from 21st July 2014 after latest revision Exgratia retirees get Rs350+DR 2912 +CMB Rs 1000=Rs4262pm.

Greetings, R.B.KISHORE,VP, AIRIEF

Living and existing !

The debate turning out to be interesting and a little diversion form unchanging pension upgradation and DA issues.

- I remember vaguely a joke read decades ago in Babu Rao Patel's Mother India.When some one conveyed to Mr. Patel that so and so died he said with a surprised look and an element of disbelief, he was living and said aside that he was only 'existing'! And so I support Mr. Srinivasa Murty's suggestion to rename it Life Certificate.

Chandigarh hearing - Coming back to our familiar subject there was a hearing scheduled for 25th Aug in Chandigarh H C which is reportedly adjourned to first week of Sept. But there is no mention of it in the blog. Does it relate any writ plea or any other matter I do not know. Can our Chandigarh friends throw light?

T SAMPATH IYENGAR

Existence certificate - discussion continues.

Dear Sri Gangadharan,

Slight diversion from the serious Pensioners' issues,

I propose that in keeping with the Modi Government's Policy, Self Certification (like Self Attestation) should be accepted. When I sign a declaration that I am alive, LIC

Slight diversion from the serious Pensioners' issues,

to how to prove we exist, is welcome for a change.

If I may continue the discussion in the lighter vein in which it is moving, I wish to ask: Do we deserve to exist if nobody is wiling to certify the fact?

If I may continue the discussion in the lighter vein in which it is moving, I wish to ask: Do we deserve to exist if nobody is wiling to certify the fact?

I propose that in keeping with the Modi Government's Policy, Self Certification (like Self Attestation) should be accepted. When I sign a declaration that I am alive, LIC

has no business to dispute it, unless it can prove that I am dead. (According to Jaipur Judgement).

LIC may also be happy to accept self declaration if the Pensioner gives consent to receive some 2.5% less Pension pa. (Self Declaraion Extra).

Another request is: Change the name from "Existence Certificate" to "Life Certificate" After all, we are living

not merely existing.

Thanks and regards,

M. Sreenivasa Murty

Thanks and regards,

M. Sreenivasa Murty

Existence Certificate

|

| Wish GNS had retired as ED ! |

While joining this issue, I am of the view that heavens won't fall if the said attestation power for Existence Certificate to be submitted by LIC Pensioners every year is given to all Retired LIC Employees also so that all retired colleagues can extend help to their fellow brothers and sisters.

May I request our stalwarts like S/Sh.R.B. Kishore, C.H. Mahadevan and all other senior Retired EDs to take up this issue with our current Top Management on priority basis.

B.R.Mehta

Panchkula

On the BANK FRONT

IMPROVEMENT

IN PENSION – COURT CASES AND OTHER RELATED MATTERS.

does not exist anywhere in the country.

All efforts to persuade the bank to rationalize the pension of State Bank employees could not yield any success. The Federation of the pensioners finally took a decision to file a special writ petition in the Supreme Court of India. After 2 years the Supreme Court transferred the petition to Delhi High Court. The Delhi High court unfortunately has clubbed our case with some other cases of Jharkhand High Court and the case now is slated to be heard on 25th of September 2014. The long delay in getting justice has sent a wave of frustration in the SBI pensioners across the country. The Federation has requested the United Forum of Bank Unions (UFI) to pay atterntion to the vows of the Bank pensioners and help in removing the injustice.

The Representatives of United Forum of Bank Unions recently met with the Finance Minister for directions to the Indian Banks Association to finalize the wage settlement. The matter, it is reported, is under consideration in the Finance Ministry. The Bank Unions are promising that they will strive for improvement in the pension scheme in the Banking Industry. Our past experience has been disappointing. Let us hope that wiser counsel will prevail this time and the unions will actually work for the improvement in the pension scheme.

In every meeting the members have been expressing their anger on the present state of affairs. They probably feel that the Federation/Asociations are not doing enough for the benefit of pensioners. We request the members to be patient and do not get carried away by rumours. Your representatives are aware of your frustration and are striving to work for the benefit of pensioners.

(Excerpts of Circular of SBI Pensioner Federation.-Ed.)

Courtesy: RB Kishore.

Tuesday, August 26, 2014

EXISTENCE CERTIFICATE

Dear Editor,

One of the today's issues is the submission of Existence Certificate.

This certificate needs to be certified by any of the following.

1.Gazetted

Officer.

2 Class-I officer of LIC

3.HGA

4.Development Officer with 5

years service as DO.

5.Bank Manager

6. Registered Doctors.

During

the early years as pensioner, there is not much difficulty in obtaining

the certificate as there are many younger colleagues in LIC offices who

know the pensioners.

The

difficulty starts after a few years when the serving younger

colleagues, knowing the pensioners disappear because of their

retirements or transfer elsewhere. This difficulty starts gaining

momentum for the pensioners in the late seventies when many of them are

unable to make any movement. Bank Managers remain busy during their

working hours resulting in keeping the pensioners, approaching them for

existence certificates, wait for hours. More over, some of the Banks

charge some amounts for such certificates. Medical practitioners charge

amounts equal to their consultation fees.

The

difficulty starts after a few years when the serving younger

colleagues, knowing the pensioners disappear because of their

retirements or transfer elsewhere. This difficulty starts gaining

momentum for the pensioners in the late seventies when many of them are

unable to make any movement. Bank Managers remain busy during their

working hours resulting in keeping the pensioners, approaching them for

existence certificates, wait for hours. More over, some of the Banks

charge some amounts for such certificates. Medical practitioners charge

amounts equal to their consultation fees.

Gazetted officers are reluctant to issue existence certificate unless the pensioners are known to them personally. This problem is more relevant in metros like Chennai, Mumbai, kolkata, Delhi, Hyderabad, Bangaore.

In view

of this burning problem for the pensioners, the Associations /

Federations should approach the CO for liberalising the requirement of

Existence certificate by Specified officials (as mentioned above). The Central Government is considering dispensing with the attestation by

gazetted officers and introducing the self attestation. Now the bank

accounts can be opened with self attested copies of documents. Mobile

Sims are activated on the basis of self attested documents.

Subir kumar Mazumder

Subscribe to:

Posts (Atom)